are political contributions tax deductible for corporations

The amount of the deduction for a contribution or gift of property is either the market value of the property on the day the contribution or gift was made or the amount. Ad Web-based PDF Form Filler.

Required electronic filing by tax-exempt political organizations.

. For amounts over 750 33 will be charged. Are Political Contributions Tax Deductible For Corporations. Political contributions arent tax deductible.

Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal state and local elections and to contribute. You can only claim deductions for contributions made to qualifying organizations. Businesses cannot deduct contributions they make to political candidates and parties or expenses related to political campaigns.

However the IRS does not allow contributions to any politician or political party to count as a. Political contributions deductible status is a myth. Qualified contributions are not subject to this limitation.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations. If you contributed to a registered federal political party or to a candidate for election to the House of Commons you will get a tax credit which is deducted from your.

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. Any contributions gifts or payments made to political organizations are not considered tax-deductible as stated by the Internal Revenue Service which maintains. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years.

The agency also bans businesses. This form itemizes your taxes to understand better what is or is not. To a state local or district party.

You are to itemize your taxes on form 1040 Schedule A. 10000 combined To a national party. Businesses that incur political expenses need to.

These taxes should be documented and kept for future reference. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified. A tax deduction allows a person to reduce their income as a result of certain expenses.

In a nutshell the quick answer to the question are political contributions. Edit Sign and Save Political Org Tax Return Form. Its Written Into the Tax Code The Internal Revenue Service IRS also.

The Taxpayer First Act Pub. The Taxpayer First Act Pub. IRS 1120-POL More Fillable Forms Register and Subscribe Now.

And if you check the box when filling. These limits apply to all contributions except contributions from a candidates personal funding. There are five types of deductions for.

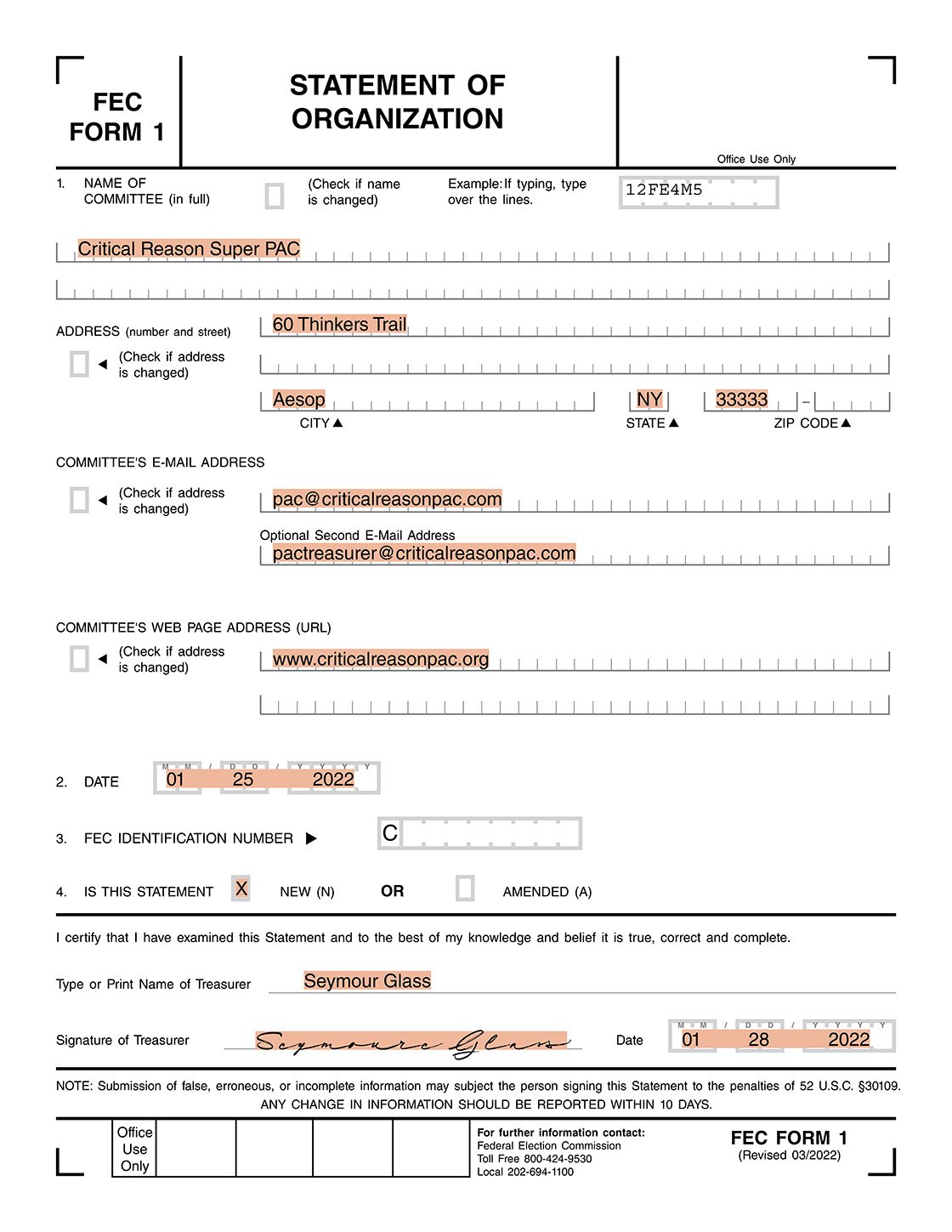

Are Political Contributions Tax Deductible

Aapa Political Action Committee Pa Pac Aapa

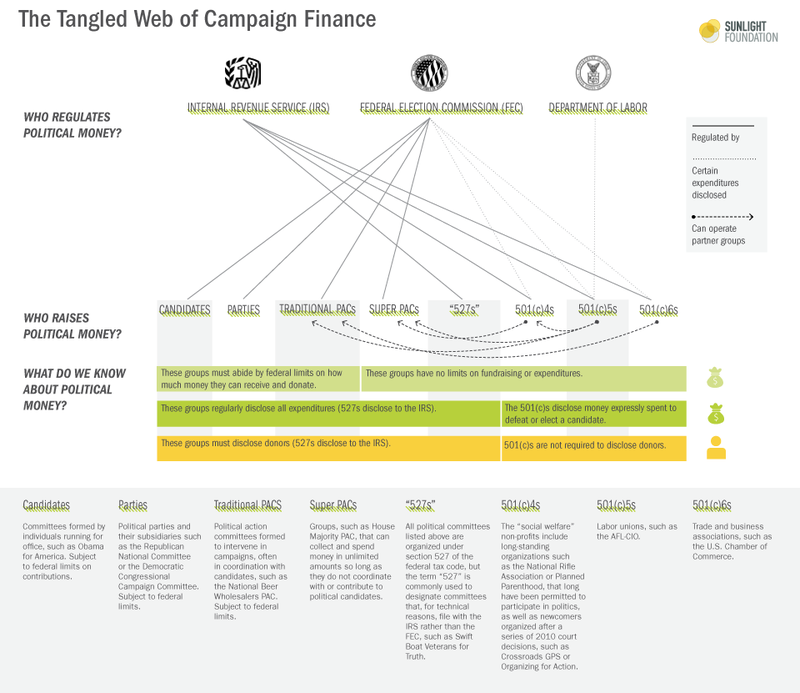

Campaign Finance In The United States Wikipedia

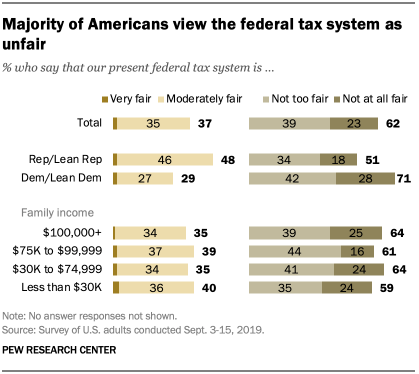

Domestic Policy Views Of Taxes Environment Health Care Pew Research Center

Why Political Contributions Are Not Tax Deductible

/hard-money-soft-money_final-0223d3d452a049dc95a8a05b20c9142a.png)

Hard Money Vs Soft Money What S The Difference

Are Political Contributions Tax Deductible Personal Capital

Archive Governor Andrew Cuomo On Twitter Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of Charitable Tax

Tax Advantages For Donor Advised Funds Nptrust

Nonprofit Law In Romania Council On Foundations

Nonprofit Law In Russia Council On Foundations

Ohio Counseling Association Donate To The Oca Pac Fund

Charitable Contributions How Much Can You Write Off Legalzoom

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Charitable Contribution Deductions Internal Revenue Service

What Is A Tax Write Off Tax Deductions Explained The Turbotax Blog

Are Political Donations Tax Deductible Credit Karma

17 Big Tax Deductions Write Offs For Businesses Bench Accounting